“LGDX gives advisors and their clients access to a strategy that’s served institutional portfolios for nearly four decades,” said Andre Prawoto, Head of Strategy at Intech. “Crossing the $100 million mark so early reflects confidence in the strategy and establishes a strong foundation for broader platform access and model portfolio inclusion.”

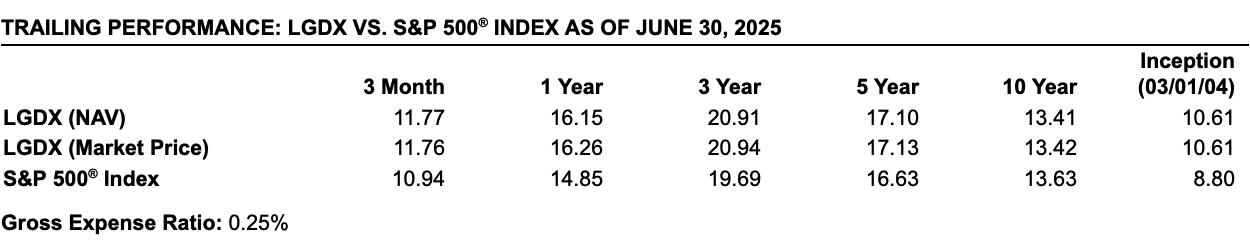

Launched on February 27, 2025, LGDX outperformed the S&P 500 Index in its first full calendar quarter as an ETF, continuing the long-term track record of its predecessor fund, which has been live since March 1, 2004.

Performance data quoted represents past performance. Past performance does not guarantee future results. Investment return and principal value will fluctuate, so shares may be worth more or less than the original cost when sold. Current performance may be higher or lower than that shown. For the most recent month-end performance, visit https://www.intechetfs.com/lgdx

LGDX performance history before 02/27/2025 reflects the results of the predecessor fund, a commingled private investment vehicle that was not registered under the Investment Company Act of 1940. The predecessor fund was managed using the same strategy and objectives as the ETF; however, it was not subject to the same regulatory, fee, or expense structure, which may have impacted its results. Net asset values (NAVs) of the predecessor fund were used for both NAV and market price performance from inception to the listing date. Performance reflects the deduction of applicable predecessor fund fees and expenses. For periods after 02/27/2025, ETF performance reflects the deduction of all applicable fund expenses, including management fees, trading costs, and other operating expenses. Returns would have been higher if the ETF’s lower expense ratio had been applied historically over time.

LGDX launched alongside SMDX, Intech’s SMID-cap ETF, as part of the firm’s broader effort to bring its institutional strategies to financial advisors and individual investors. Both funds have gained early traction, reflecting advisor demand for systematic approaches with institutional roots—delivered in transparent, tax-efficient vehicles built for long-term portfolio construction.

About Intech

For over 38 years, Intech has been at the forefront of systematic investing, pioneering strategies that harness the power of diversification and rebalancing to optimize equity portfolios. With $14.7 billion in assets under management as of June 30, 2025, Intech’s research-driven approach—trusted by pension funds, endowments, and sovereign wealth funds—is now accessible to all investors through Intech ETFs, offering a new way to think about passive investing in a rapidly evolving market. Learn more at www.intechetfs.com.

Media Contact

Amiee Watts

FLX Networks

amiee.watts@flxnetworks.com

1-973-615-1683