West Palm Beach, FL – November 13, 2025 – The Intech S&P Small-Mid Cap Diversified Alpha ETF (NYSE Arca: SMDX) has surpassed $100 million in assets under management, less than a year after launch.1 Together with its large-cap counterpart, Intech S&P Large Cap Diversified Alpha ETF (LGDX), Intech’s ETF lineup now exceeds $225 million in combined assets.1

According to Broadridge’s Active ETFs: Achieving Escape Velocity (Broadridge Financial Solutions, 2025), only 11% of active ETFs raise more than $100 million in their first year, and those that do represent nearly two-thirds of all active ETF assets. Reaching this level so quickly signals early traction and long-term viability in the competitive active ETF market.

“Crossing $100 million so early puts SMDX in rarified air,” said Dr. Jose Marques, CEO of Intech. “Few active ETFs reach this scale in their first year. It validates that our institutional process works in the ETF structure—and that our approach resonates where markets are most complex.”

Intech ETFs bridge the gap between passive simplicity and active results, combining stock fundamentals with volatility- and correlation-based portfolio design to deliver transparent, index-aligned exposures. Both ETFs trade on NYSE Arca and are designed for scalable use in advisor and institutional portfolios.

As capital continues moving from mutual funds to ETFs, small-cap exposures remain underserved. SMDX’s active design combines small-cap breadth with mid-cap stability—offering a natural core for investors seeking simple exposure while striving for a performance edge.

“Few active ETFs reach this scale in their first year. It validates that our institutional process works in the ETF structure—and that our approach resonates where markets are most complex.”

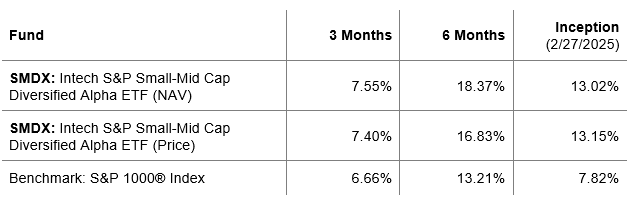

Since inception, SMDX has outperformed its benchmark, demonstrating how diversification-weighted investing can enhance index exposure across small- and mid-cap stocks.

SMDX Standardized Performance (as of 09/30/2025)

Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. For ETFs, the market price return is calculated from closing prices as determined by the fund’s listing exchange. If you trade your shares at another time, your return may differ. Brokerage commissions and other fees may apply. Performance includes reinvestment of dividends and other earnings. Returns for periods shorter than one year are not annualized. For the most recent month-end performance, visit IntechETFs.com. Please read the prospectus or summary prospectus carefully before investing.

About Intech

For over 38 years, Intech has been at the forefront of systematic investing, pioneering strategies that harness the power of diversification and rebalancing to optimize equity portfolios. With $15 billion in assets under management as of September 30, 2025, Intech’s research-driven approach—trusted by pension funds, endowments, and sovereign wealth funds—is now accessible to all investors through Intech ETFs, offering a new way to think about passive investing in a rapidly evolving market. Learn more at www.intechetfs.com.

Media Contact

Amiee Watts

FLX Networks

amiee.watts@flxnetworks.com

1-973-615-1683