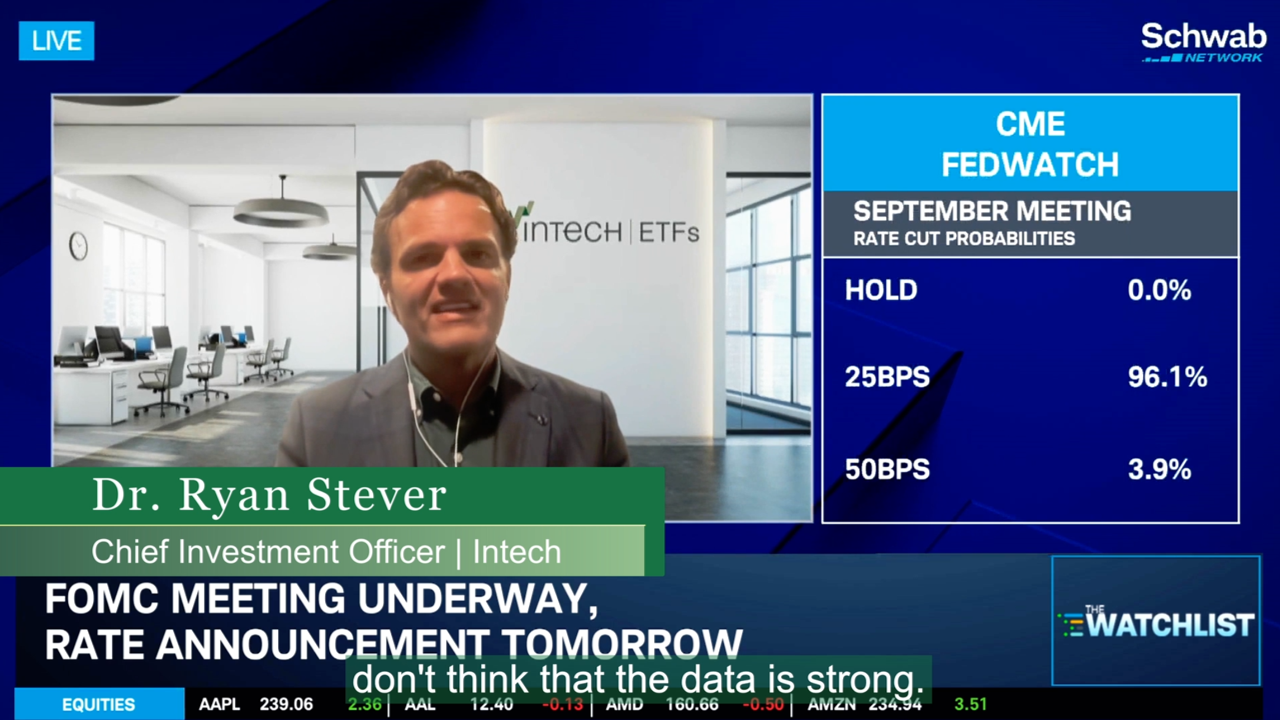

Ryan Stever, PhD, Chief Investment Officer at Intech Investment Management, appeared on the Schwab Network from the NYSE studio to discuss current market conditions, including inflation trends, Federal Reserve policy considerations, developments in artificial intelligence, and how these dynamics may influence portfolio construction as markets look toward 2026.

Speaking with Schwab Network anchor Nicole Petallides, Stever focused on the evolving market environment and the importance of interpreting macroeconomic signals within a broader investment context.

Inflation: A More Nuanced Backdrop

Stever noted that inflation dynamics have shifted compared to prior periods. While headline inflation measures have moderated from earlier levels, underlying price pressures remain uneven across sectors of the economy.

“In today’s environment, inflation data needs to be viewed in context,” Stever said. “It’s less about any single data point and more about how pricing trends interact with growth, earnings, and policy over time.”

Rather than treating inflation as a standalone signal, Stever emphasized considering it as one component of a broader market backdrop—particularly when assessing how portfolios may behave across different scenarios.

Federal Reserve Policy and Market Interpretation

Discussing the Federal Reserve, Stever cautioned against assuming that individual policy decisions necessarily define a clear or sustained rate path.

Market participants, he noted, are weighing a combination of factors, including inflation that has moderated but remains elevated relative to longer-term targets, economic growth that has shown resilience alongside signs of moderation, and financial conditions that can shift as expectations evolve.

“Policy decisions are being made in an environment with competing signals,” Stever said. “That uncertainty can make short-term interpretation challenging.”

In this setting, he underscored the relevance of maintaining a disciplined approach rather than relying on precise policy forecasts.

Artificial Intelligence, Earnings, and Fundamentals

Turning to artificial intelligence, Stever acknowledged the growing role of AI across the economy while noting that market outcomes ultimately reflect company fundamentals.

“Technological innovation can be significant,” he said. “But over time, markets tend to differentiate based on earnings, cash flows, and how broadly economic benefits are realized.”

Stever observed that periods of innovation are often associated with greater dispersion in company performance, as markets reassess valuations and long-term prospects at the individual stock level.

Dispersion and the Role of Diversification

Across each topic, Stever returned to a recurring theme: the contrast between relatively stable index-level market measures and wider variation beneath the surface.

He pointed to increasing dispersion—differences in returns among individual companies—as an important feature of the current environment. In his view, this highlights the role of diversification that is intentionally constructed rather than assumed based solely on broad market exposure.

“When index-level volatility is low, it can mask what’s happening within the market,” Stever said. “That makes diversification and portfolio construction decisions especially important.”

Framing the Path Toward 2026

Looking ahead, Stever noted that uncertainty has long been a characteristic of financial markets. What varies, he suggested, is how investors position portfolios in response to changing conditions.

Rather than anchoring expectations to a single economic or policy outcome, he emphasized the value of approaches designed to operate across a range of potential environments while remaining aligned with long-term objectives.

“Markets evolve,” Stever said. “The focus is less on predicting specific outcomes and more on maintaining a framework that can adapt as conditions change.”

Bottom Line

As markets navigate a period shaped by shifting inflation dynamics, evolving policy considerations, and uneven impacts from technological change, clarity is not always immediate. In this environment, Ryan Stever emphasized the importance of interpreting signals within a broader context rather than anchoring on any single outcome. While uncertainty remains a constant feature of markets, maintaining a disciplined framework—one that accounts for dispersion, diversification, and structural change—is potentially more durable than relying on short-term forecasts.