For decades, core equity investing has been defined by a binary choice: embrace passive indexing or pursue active management. Both approaches have compelling advantages. Passive strategies deliver low costs, transparency, and benchmark consistency. Active managers offer the potential for differentiated returns and tactical agility.

But as markets evolve, so do the shortcomings of these traditional approaches. Increasingly, investors find themselves in what could be called the core equity deadlock—where neither option fully addresses today’s market risks.

The Structural Weaknesses of Core Equity Strategies

Cap-Weighted Indexing: The Concentration Problem

Cap-weighted indexes are efficient and inexpensive, but they come with an inherent bias: the largest companies exert the most influence over performance. This bias has become more pronounced over the past decade, with a handful of mega-cap stocks now representing a substantial portion of index weight. While these names have been strong performers, their dominance can magnify portfolio vulnerability when leadership shifts.

Equal-Weighted Indexing: The Volatility Trade-Off

Equal-weighted strategies attempt to solve the concentration problem by giving each stock the same influence. While this approach redistributes weight toward smaller companies, it can also increase portfolio volatility and tracking error. When small caps underperform, equal-weighted portfolios can lag materially for extended periods.

Factor-Based Strategies: The Cyclicality Challenge

Factor-based approaches tilt toward characteristics like value, momentum, or quality. While these can capture long-term premiums, they are inherently cyclical. Periods of underperformance can test investor discipline, and factor crowding can erode potential benefits. Overreliance on a single factor—or a small set of factors—can also introduce unintended risks.

Conventional Active Management: The Consistency Gap

Active strategies depend on manager skill in security selection and timing. While some deliver periods of outperformance, persistence is rare historically. Fees, style drift, and human biases can further erode returns. This inconsistency makes it difficult for active strategies to serve as a dependable core allocation.

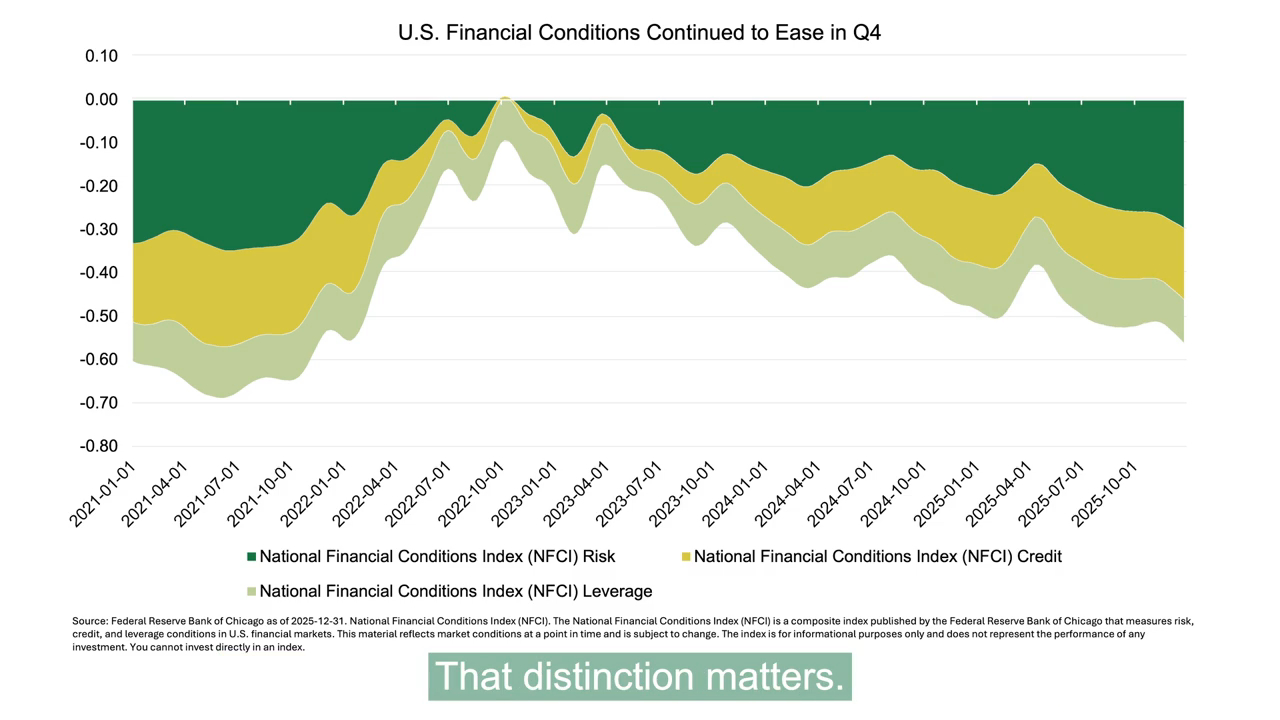

Why These Risks Are Growing

In isolation, each of these trade-offs might seem manageable. But in today’s environment, they are amplified by structural and macroeconomic shifts:

- Narrow Market Leadership – Index performance increasingly depends on a small group of dominant companies, making portfolios more sensitive to their earnings and valuations.

- Heightened Dispersion – Stock returns are moving less in lockstep, increasing both opportunity and the potential for underperformance if the wrong exposures dominate.

- Macro Uncertainty – Higher interest rates, shifting inflation expectations, and geopolitical tensions can drive sudden sentiment changes that ripple through portfolios.

- Factor Instability – Historical factor relationships may not hold in the face of technological disruption, supply chain shifts, and changing consumer behavior.

Together, these dynamics create an environment where the weaknesses of any single approach—passive, factor-based, or active—are harder to ignore.

"Core equity should be diversified, scalable, and built for all seasons."

What's at Stake?

Core equity is the foundation of most portfolios. If that foundation is unstable—overexposed to a small group of companies, tied to a cyclical factor bet, or dependent on unpredictable stock-picking—it can undermine portfolio resilience, investor confidence, and long-term outcomes.

For fiduciary advisors and platform gatekeepers, these risks aren’t theoretical. They can complicate client conversations, stress model portfolio construction, and increase the likelihood of performance chasing.

Recognizing the Need for a Third Path

Identifying the problem is the first step toward solving it. The core equity deadlock is not about rejecting indexing or abandoning active management—it’s about acknowledging their limitations and exploring solutions that can address structural risks while preserving the strengths investors value.

The search for a more adaptable core allocation begins by asking:

- How can we maintain the scalability and transparency of indexing without inheriting its concentration bias?

- How do we avoid the volatility and cyclical underperformance that can come from equal-weighted or factor-heavy strategies?

- How do we achieve greater resilience without introducing excessive tracking error or complexity?

These questions set the stage for a more balanced approach—one that doesn’t force investors to choose between efficiency and adaptability.

What Comes Next

The weaknesses in core equity portfolio construction aren’t new, but their urgency has grown. Narrow market leadership, heightened dispersion, and macro uncertainty have made the trade-offs of traditional strategies more costly. Addressing them requires rethinking how we balance risk and return in a portfolio’s foundation.

If you’re rethinking your core equity allocation, the first step is recognizing the constraints of the current choices.

Download the full paper to understand the structural risks in greater detail and explore what a third path might offer.