Why Clean Market Cap Coverage Matters

For most investors, the core U.S. equity allocation is the largest single source of portfolio risk. It’s also the part of the portfolio that should be the most straightforward — broad exposure, consistent risk profile, and easy integration with the rest of the allocation. Yet in practice, it’s often more complicated than it needs to be.

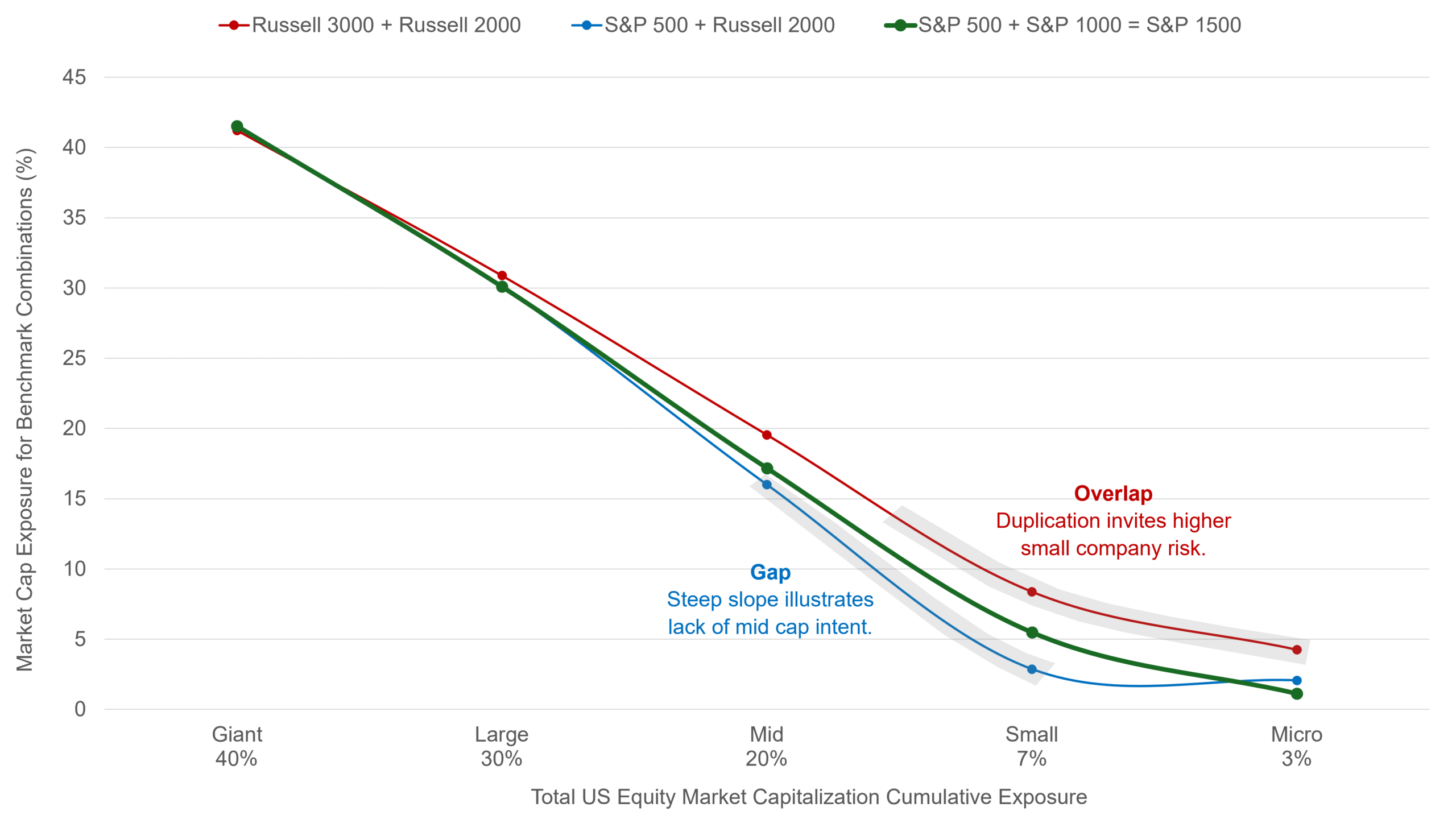

One reason is manager benchmarks. Many active ETF lineups pair funds in ways that sound comprehensive such as S&P 500 + Russell 2000 or Russell 3000 + Russell 2000 (strange, right?), but in reality they introduce overlap, gaps, and unintended tilts. These mismatches make it harder to track policy benchmarks, attribute performance, and maintain diversification discipline.

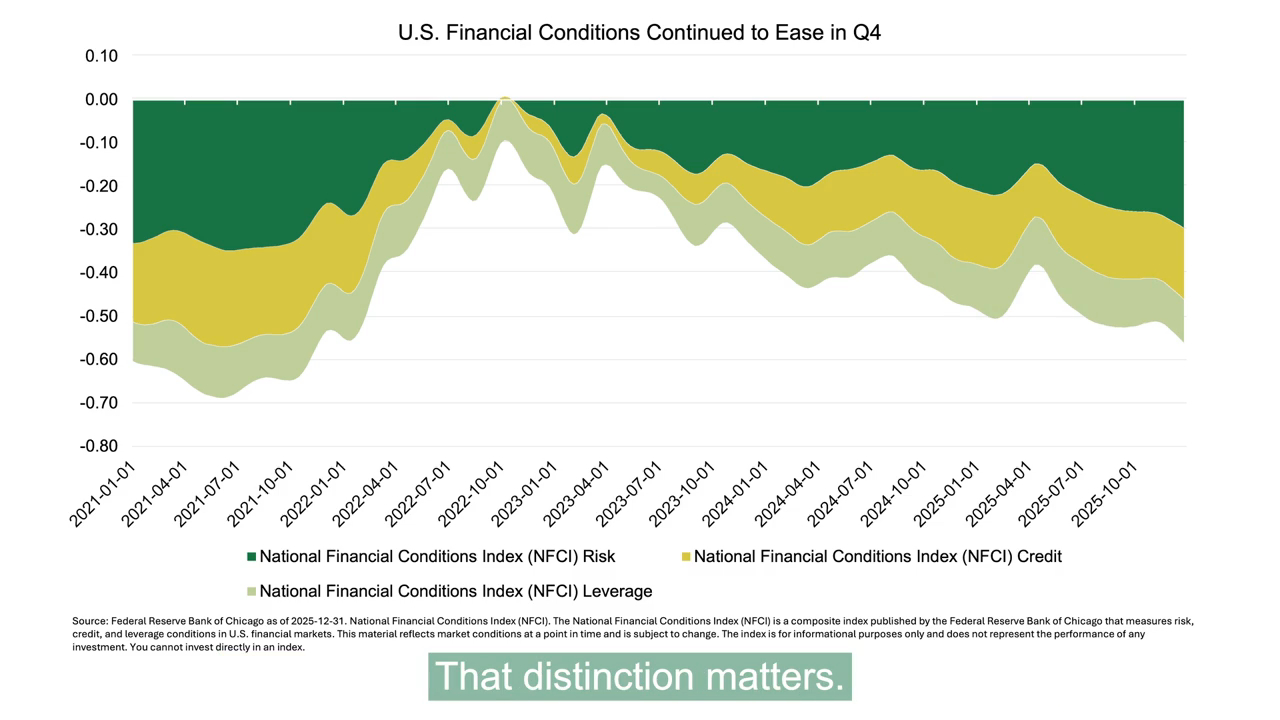

Avoid the Extremes: Smoother Market Cap Curve Using S&P 500 + S&P 1000

The chart below compares three common index pairings using Morningstar’s market cap segments. Notice how S&P 500 + S&P 1000 (green) produces a smoother decline across cap buckets, while other combinations show sharper drop-offs and imbalances. A smoother curve signals more even market coverage, which can help reduce unintended portfolio tilts.

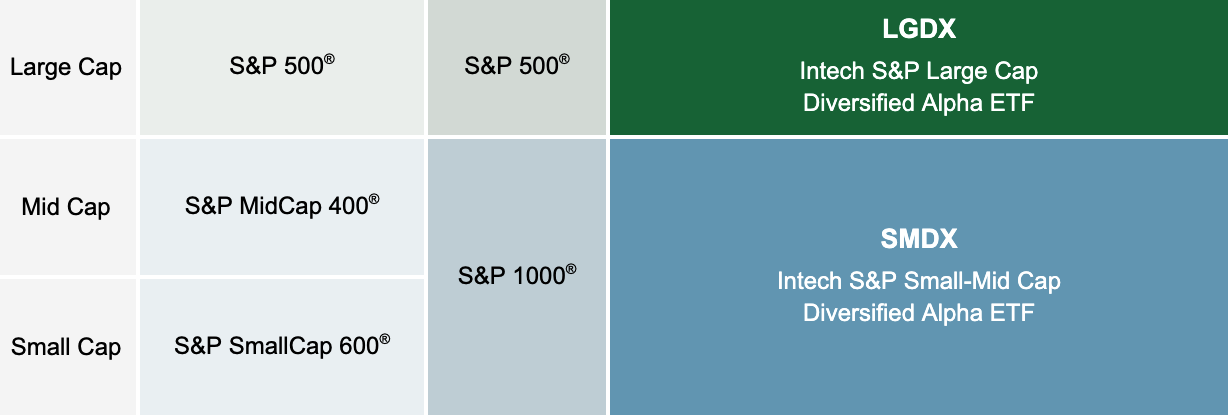

Seamless Integration: LGDX + SMDX

Intech’s two U.S. equity ETFs — LGDX (Large Cap Diversified Alpha) and SMDX (SMID Cap Diversified Alpha) — are designed as complementary building blocks. Combined, they align closely with the S&P 1500, providing exposure to large, mid, and small caps while seeking to limit duplication or style drift.

Because both ETFs share a common diversification methodology and maintain benchmark awareness, their risk and return profiles integrate smoothly. This allows allocators to maintain benchmark alignment while removing the inefficiencies of overlapping index coverage.

Why SMID Cap?

SMID — the combined small- and mid-cap segment — is often overlooked in portfolio construction. Many allocations pair large + small, leaving mid caps out entirely, or small + mid without a clean link back to the large-cap core. Both approaches can create coverage gaps and uneven risk exposures.

Mid caps occupy a unique space: they often have the operational scale of large companies while retaining meaningful growth potential. Small caps contribute higher long-term return opportunities and diversification benefits, albeit with greater volatility. Combining them in SMID captures the strengths of both segments and preserves exposure to successful small caps as they graduate into mid caps, helping to avoid the forced selling that can occur in single-segment strategies.

Because SMID blends two dynamic market segments, it also creates more frequent rebalancing opportunities, as Intech’s investment process has more chances to refresh diversification and capture trading profits.

SMDX provides dedicated small- and mid-cap exposure that complements LGDX’s large-cap focus. Used together, the two ETFs seek to provide seamless coverage of the U.S. equity market without gaps or unnecessary overlap. This structure makes it straightforward to implement and maintain a total-market allocation that may evolve naturally as company capitalizations change.

Seamless market coverage that’s straightforward to implement, simple to maintain, and built to adapt as markets evolve.

Implementing Baseline Allocations

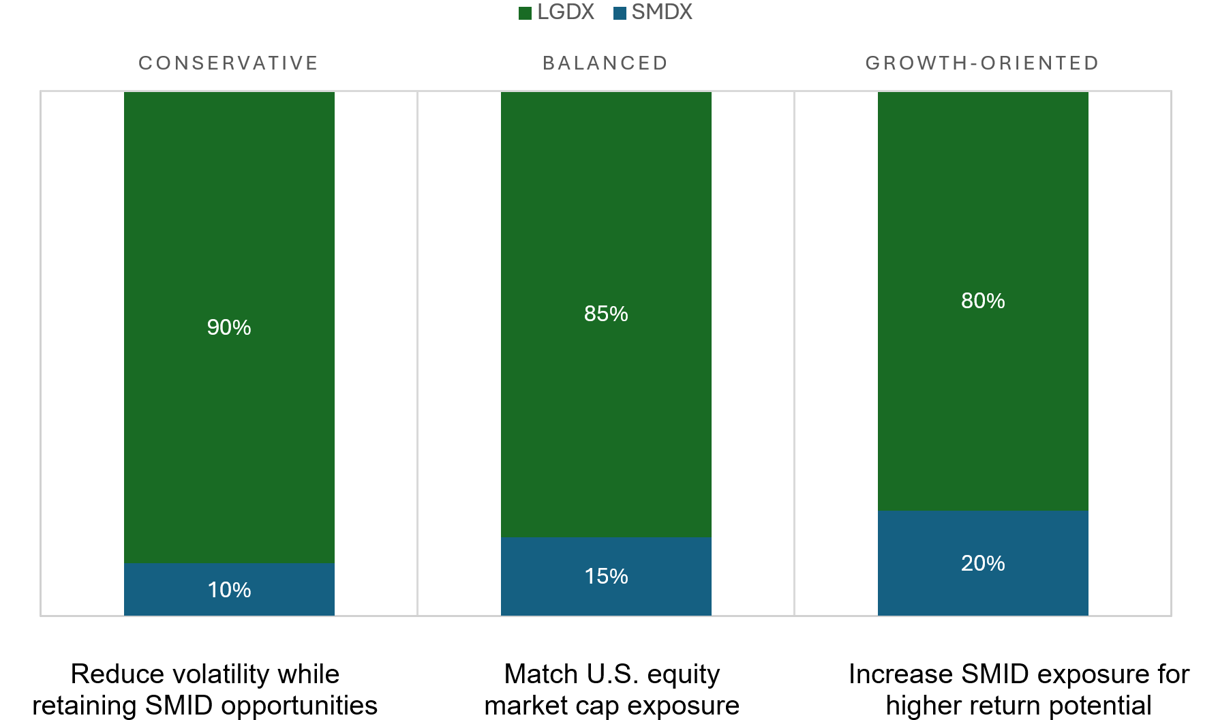

To replicate the typical capitalization weights across large, mid, and small caps, allocators can start with 85% LGDX and 15% SMDX. This split reflects approximately the S&P 1500 Index’s market cap distribution, though it should be rebalanced periodically as market composition changes.

Why This Matters

- A typical 80/20 large/small split often overweights small caps and underweights mid caps, skewing sector and style exposures.

- Aligning weights to the S&P 1500 helps maintain consistent tracking to policy portfolios and avoids these imbalances.

Hypothetical Equity Allocations

While every portfolio is different, most allocators aim to reflect the U.S. equity market’s natural distribution across large, mid, and small caps. The chart below illustrates how combining LGDX and SMDX can be tailored to match different risk profiles from conservative to growth-oriented while maintaining comprehensive market coverage.

Four Practical Use Cases

While LGDX and SMDX can be paired for seamless total market coverage, they’re also versatile tools that fit a variety of portfolio construction needs. Whether you’re replacing an existing core allocation, filling a size segment gap, or managing through a transition, these ETFs can be deployed with minimal disruption and clear alignment to benchmark-driven objectives. Here are four common ways allocators put them to work:

1. Core Replacement

Replace an existing large/small allocation with LGDX + SMDX to achieve true total market coverage. This eliminates duplication, balances risk across size segments and ensures alignment with benchmark composition while quietly pursing alpha (the excess return of a portfolio relative to its benchmark, typically on a risk-adjusted basis). The result is a core allocation that aims to do more than simply mirror the market, without taking on excessive tracking error.

2. Satellite Diversifier

Use LGDX to offset the concentration risk of a high active risk strategy, such as a focused stock portfolio, thematic sleeve, or private equity exposure. Conversely, use SMDX as a large-cap diversifier, adding targeted SMID exposure to counterbalance portfolios dominated by mega-cap names. In both cases, the allocation also adds the potential for a differentiated return stream, sourced from two independent drivers — fundamental stock selection and volatility capture through disciplined rebalancing — that aim to behave differently from traditional fundamental and quantitative styles.

3. Transition Tool

During manager changes or strategy shifts, LGDX + SMDX can serve as a temporary, benchmark-aligned placeholder, keeping size and sector exposures intact. This approach preserves intended market coverage while managing risk and seeking incremental alpha (the excess return of a portfolio relative to its benchmark, typically on a risk-adjusted basis) through ongoing diversification and rebalancing, helping the portfolio remain productive even in transition.

4. Portfolio Completion

Many portfolios unintentionally skip or underweight SMID. Adding SMDX alone can fill this gap, improving diversification and cap-size balance without disrupting existing strategies. And because the process seeks to capture a rebalancing premium, this targeted allocation offers the potential for incremental alpha while maintaining alignment with the overall policy benchmark.

The Bottom Line

Clean, complete market coverage isn’t just an operational advantage — it’s a portfolio construction advantage. LGDX and SMDX together offer full U.S. equity market exposure aligned to the S&P 1500, while seeking to limit overlap, gaps, or unintended bets. Whether used together or selectively, they give allocators a straightforward way to maintain market coverage and improve portfolio efficiency.

See how LGDX and SMDX can strengthen your total market coverage.