In a recent post, we outlined the structural challenges in today’s core equity strategies — concentration risk, macro uncertainty, factor instability, and performance swings. For fiduciaries managing model portfolios, these flaws may disrupt risk budgets, complicate governance, and undermine allocation discipline. Intech ETFs are designed to address these issues while keeping the features fiduciaries value most: benchmark alignment, predictable risk characteristics, and disciplined, transparent implementation.

Intech ETFs are engineered to address these issues without sacrificing the transparency, scalability, and efficiency that make index-based allocations so valuable.

Mitigating Overconcentration

Today’s headline concentration in a few mega-cap names is a clear example of a broader, persistent challenge: structural imbalances in index construction. Traditional cap-weighted indexes allocate solely by market capitalization, without regard for how individual holdings interact or how risk is distributed.

This approach can leave portfolios vulnerable to unintended exposures — whether it’s a small set of companies dominating returns, a particular sector contributing too much risk, or correlations tightening during stress periods.

Intech addresses this by seeking a more balanced distribution of risk and return across holdings. Our systematic process continuously measures relationships between stocks and refreshes weights to reflect evolving market conditions. This attempts to reduce dependency on any single source of risk while preserving exposure to the leaders that drive market performance.

That means a core equity allocation that remains aligned with policy benchmarks yet adapts to shifts in the market’s risk structure, seeking to maintain stability and predictability in model portfolios over time.

Optimized Diversification

Equal-weighted strategies address concentration by giving every company in the portfolio the same weight, but that simplicity comes at a cost: persistent small-cap exposure and higher volatility. In a model portfolio, those characteristics can be difficult to offset elsewhere without disrupting the allocation.

Intech’s approach keeps the full benchmark universe intact but diversifies based on how stocks move in relation to each other rather than just their market cap or factor profile. This allows us to spread risk more efficiently, aiming to avoid an overcommitment to smaller, more volatile names while still broadening the opportunity set beyond the largest holdings.

The result is a more balanced, policy-friendly diversification that maintains alignment with the benchmark’s sector and style weights, which can make the impact of factor timing integration into model portfolios far simpler.

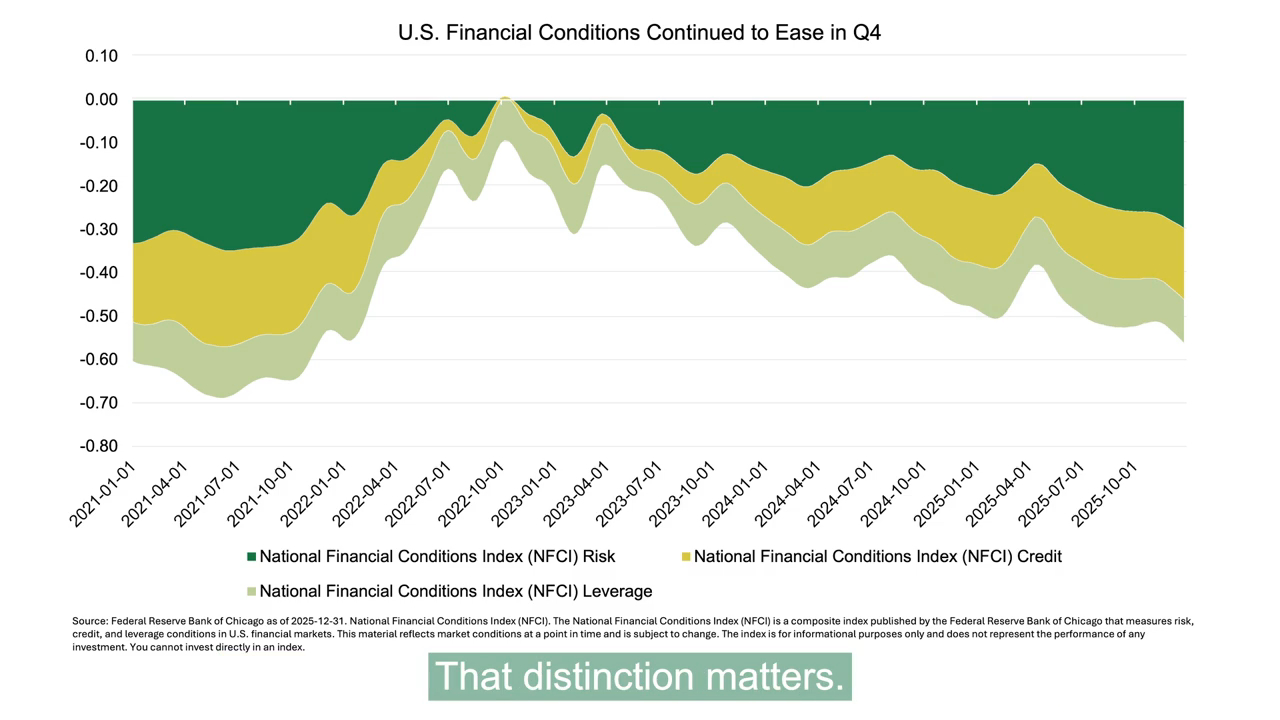

Adaptive Factor Exposure

Some strategies systematically toward multiple drivers of expected returns — for example, combining value, size, and profitability tilts in pursuit of long-term premiums. While these tilts can deliver value in certain environments, they also lock portfolios into exposures that can underperform for extended periods.

In a model portfolio, persistent tilts can create performance patterns that are out of sync with other allocations. They can also magnify cyclical risk, making it harder for fiduciaries to maintain allocation discipline without frequent adjustments.

Intech takes a different approach. We measure factor exposures continuously and dynamically adjust them based on prevailing market conditions. This adaptability is designed to reduce the impact of factor timing, minimizes concentration in any single risk driver, and avoids crowding into the same trades as many other managers.

The result is a core equity allocation that maintains its benchmark alignment while remaining responsive to the market’s shifting risk structure, seeking to serve as a complement to both passive and factor-based strategies in a diversified model portfolio.

For fiduciaries, that means a core equity allocation that remains aligned with policy benchmarks yet adapts to shifts in the market’s risk structure…

Building on the Index

Fiduciaries understand well the challenge of incorporating traditional active managers into model portfolios. While some deliver differentiated returns, they often do so with high active risk, subjective decision-making, and exposures that drift from the benchmark. Those traits can disrupt allocation targets, complicate oversight, and trigger rebalancing events that add cost and complexity.

Intech’s approach starts with allocators in mind. The benchmark’s full list of constituents is our starting investment universe, and we build from there. This preserves sector and style exposures, making strategies fit more naturally in model portfolios.

Tracking error is kept modest by design. It gives the portfolios enough flexibility to seek improved diversification and potential rebalancing benefits without introducing style drift. The process is fully systematic, removing the subjectivity that can cause inconsistency over time and ensuring the strategy’s role in the portfolio remains clear and predictable.

At the end of the day, that means capturing potential sources of return beyond the benchmark without taking on the governance headaches that often come with active stock selection.

The Bottom Line

Fiduciaries face a persistent challenge: balancing the efficiency and scalability of passive investing with the need to address its structural shortcomings. Intech ETFs are designed to do exactly that: bridge the gap with a systematic, benchmark-aware approach that fits model portfolios.

See how our strategies can strengthen your core allocation while aligning with fiduciary standards.