Most investors assume portfolio growth is simply the weighted sum of the returns of the stocks inside it. If the companies in the portfolio do well, the portfolio grows in line.

But that view is incomplete. According to Stochastic Portfolio Theory, portfolio growth comes from two independent sources: stock effects and volatility effects. One reflects the companies you own. The other reflects how those companies move together.

This second source—volatility effects—is often overlooked. Yet when measured and managed systematically, it can reshape how portfolios behave: refreshing diversification, capturing incremental gain potential through rebalancing, and reducing reliance on concentrated bets or factor cycles.

For advisors, the message is clear: portfolio growth isn’t just about the stocks you own. It’s also about how those stocks interact. Recognizing both engines creates a more complete framework for building durable core equity allocations.

“By recognizing volatility effects alongside stock effects, advisors gain a clearer picture of how portfolios compound, adapt, and hold up across shifting markets.”

Stochastic Portfolio Theory: A Broader Lens

Traditional portfolio models tend to reduce growth to one driver: the weighted sum of the returns of the securities inside it. This narrow lens works well in textbooks, but it misses how real portfolios behave in real markets.

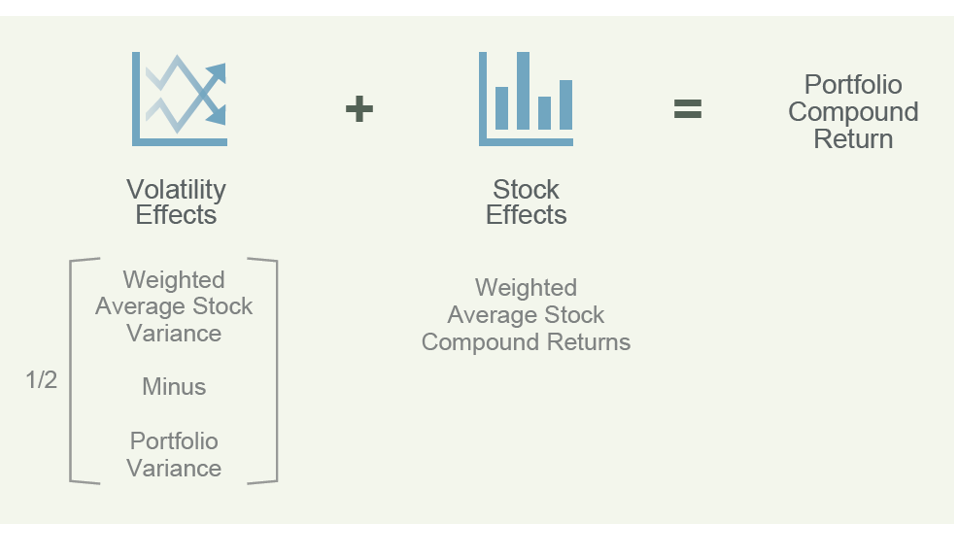

That gap is what led to the development of Stochastic Portfolio Theory (SPT). Rather than focusing only on individual securities, SPT examines the entire portfolio as a system. It separates portfolio growth into two measurable, independent components:

- Stock effects — the weighted average returns of the companies held in the portfolio.

- Volatility effects — the incremental growth potential that arises from the way those stocks interact through volatility and correlation.

This second source matters because markets don’t move in straight lines. Individual securities rise and fall at different times and at different magnitudes. Those differences—when harnessed through diversification and rebalancing—become an engine of portfolio growth in their own right (Figure 1).

Figure 1: Stochastic Portfolio Theory

Stochastic Portfolio Theory (SPT) offers a comprehensive framework of portfolio growth, viewing it as the sum of stock-level returns and volatility effects—or portfolio-level structure—two distinct, independently measurable effects.

Advisors don’t need to be mathematicians to see the value in this framework. What SPT highlights is that diversification isn’t just about owning more stocks or tilting toward factors—it’s about how the portfolio is structured and refreshed over time. By recognizing volatility effects alongside stock effects, advisors gain a clearer picture of how portfolios compound, adapt, and hold up across shifting markets.

Two Engines Explained

Stock Effects

The first engine of portfolio growth is the one investors know best: the weighted average returns of the securities inside the portfolio. If companies generate earnings, dividends, and price appreciation, the portfolio reflects those outcomes in proportion to each stock’s weight.

This is the foundation of most investment approaches. Passive strategies track stock effects by design, factor-based strategies tilt toward certain stock characteristics, and active managers attempt to identify securities with higher expected returns. In every case, the growth engine is the same: what the companies earn over time.

But focusing exclusively on stock effects has limits. Cap-weighted benchmarks concentrate returns in a handful of dominant companies, factor tilts often cycle in and out of favor, and active managers can experience prolonged drawdowns. Stock effects alone don’t explain why portfolios sometimes behave differently than the companies inside them.

Volatility Effects

The second engine is less familiar, but no less important. Volatility effects arise from the way stock prices move relative to one another. Differences in volatility and correlation create opportunities to improve diversification and to capture incremental gains through systematic rebalancing.

These effects are observable in practice. Realized volatility captures how stock prices have actually varied over time, while implied volatility reflects what the market expects for the future. Both inform how stocks interact within a portfolio and can influence when and how diversification is refreshed.

When harnessed intentionally, volatility effects can:

- Improve diversification even when market indexes are concentrated in a few names.

- Refresh portfolio balance through rebalancing, countering the natural drift of weights toward recent winners.

- Capture incremental trading profits from dispersion in stock behavior, turning volatility into a potential source of growth rather than just risk.

Together, stock effects and volatility effects create a more complete model of portfolio growth. One engine reflects the companies that investors own. The other reflects how those companies interact in a portfolio. Ignoring either, risks leaving part of the growth process untapped.

Why Volatility Effects Matter

For advisors, the distinction between stock effects and volatility effects isn’t just an academic detail. It directly influences how portfolios behave in client accounts.

- Concentration risk. Cap-weighted indexes increasingly lean on a handful of mega-cap stocks to drive returns. When portfolio growth depends too heavily on a small number of names, diversification erodes. Volatility effects help redistribute risk more evenly, reducing dependence on single companies or sectors.

- Factor drift and cyclicality. Factors like value, size, or quality can rotate in and out of favor, sometimes for years. Definitions also evolve over time, leaving portfolios vulnerable to reclassification or crowding. Volatility effects may provide a complementary source of return that adapts more dynamically as correlations shift.

- Client conversations. Explaining why a factor tilt has underperformed for a decade, or why an active manager has lagged through multiple cycles, can strain credibility. Volatility effects offer advisors a structural story that is easier to explain: portfolios refresh diversification systematically, regardless of style cycles or stock calls.

- Resilience across regimes. Market leadership changes. Macroeconomic backdrops evolve. Portfolios built with both engines—stock effects and volatility effects—are better equipped to hold up through transitions than portfolios that rely solely on stock returns.

- Uncorrelated alpha opportunities. Because volatility effects are driven by stock interactions rather than style or stock selection, the returns they generate are potentially uncorrelated with conventional sources of alpha. This makes them especially valuable for advisors seeking complementary return drivers within policy portfolios.

Volatility isn’t just noise to be suppressed. It’s information. When harnessed systematically, volatility effects can strengthen the foundation of core equity allocations, making them more adaptable, explainable, and resilient for clients.

Conclusion

Most investors stop at the first engine of portfolio growth—the weighted returns of the stocks they own. But portfolios are more than the sum of their parts. Volatility effects—how those stocks interact—add a second, often overlooked source of growth.

For advisors, the message is clear: stock effects explain what companies earn, while volatility effects explain how portfolios behave through time. Recognizing both creates a fuller framework for constructing core equity allocations—one that preserves diversification, adapts across regimes, and introduces a potential source of uncorrelated alpha.

The bottom line: portfolios aren’t just collections of stocks. They are systems of interactions. And when both engines are measured and managed, advisors gain a clearer view of what drives long-term growth.

Download the full Peregrine case study to see how one RIA incorporated both engines of growth into its core allocation.