Markets are full of stories. One year it’s the promise of tech dominance, the next it’s the resurgence of value, or the latest conviction stock touted as the next big winner. These narratives may capture attention, but they rarely endure. For advisors, leaning on stock stories or style cycles often means building portfolios on shifting ground.

Peregrine Asset Advisers takes a different view. Instead of chasing narratives, the firm emphasizes structure and process as the foundation of core equity. Dan Botti, principal and founder, has spent decades building portfolios designed to hold up over time, not just shine in the moment. As he puts it:

“Markets change. Leadership rotates. What clients need is a process—not a prediction.”

That philosophy led Peregrine to implement a systematic equity strategy from Intech—one that prioritizes diversification, rebalancing, and risk balance over stock picking or market timing. In an environment defined by concentration, volatility, and shifting leadership, the case for structure over stories has never been stronger.

Why Stories Fail Advisors

Narratives can be powerful, but they rarely provide a reliable foundation for portfolio design. Advisors have seen it time and again:

- Stock stories fade. A company positioned as the next category leader may shine briefly, only to stumble when fundamentals shift or competition intensifies.

- Style cycles reverse. Periods of dominance in growth, value, or momentum often end abruptly, leaving portfolios overexposed .

- Macro calls miss. Predicting rates, inflation, or geopolitical shocks is notoriously difficult—and when those predictions prove wrong, client portfolios pay the price.

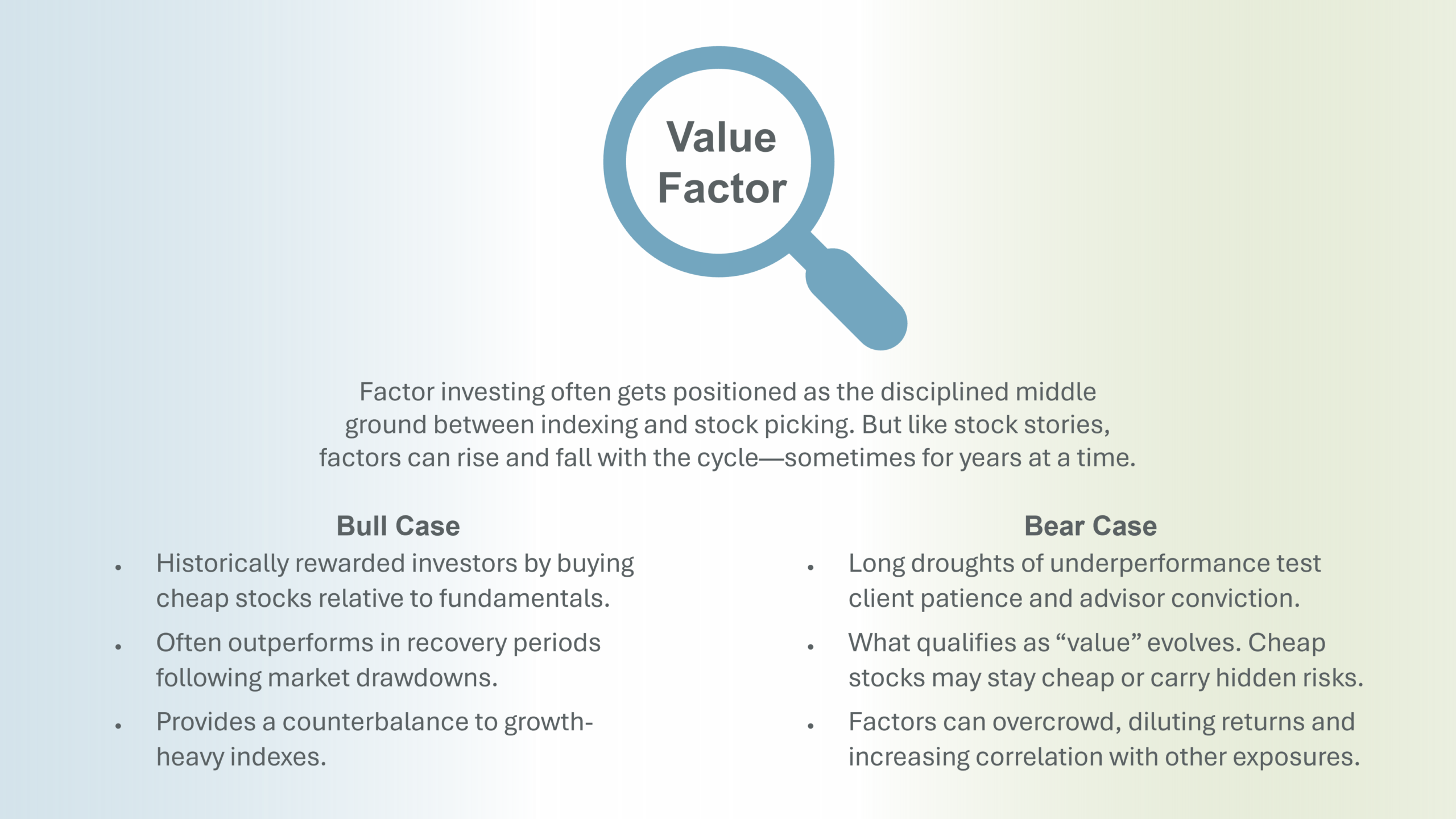

The problem with stories is not that they’re untrue, but that they’re incomplete. They capture a moment in time but fail to anticipate how markets rotate, how correlations shift, or how leadership changes (Figure1).

Figure 1: Case in Point – The Value Factor

The Case for Structure as the Anchor

For Peregrine, the solution wasn’t to chase the next stock story or factor cycle. It was to build portfolios on principles that don’t expire with market narratives. Structure—how risk is distributed, how diversification is preserved, how balance is maintained—became the anchor. Dan Botti describes it simply:

“If you build the right structure, you don’t have to guess what’s going to work next.”

In practice, that meant adopting a systematic equity strategy from Intech—one that:

- Aligns with benchmarks without mirroring their risks. Broad market exposure is preserved, but concentration is reduced.

- Refreshes diversification through rebalancing. Instead of drifting into imbalance, portfolios systematically reset to their intended structure.

- Treats volatility as information, not just noise. Price dispersion across stocks becomes a source of opportunity rather than a risk to suppress.

This isn’t a replacement for indexing or a rejection of active management. It’s a refinement—one designed to strengthen the core of client portfolios without forcing advisors into all-or-nothing choices.

Why This Resonates Today

The case for structure isn’t theoretical. It’s practical, especially in today’s environment, where:

- Indexes are more concentrated than ever. A handful of mega-cap names drive both returns and risk, leaving portfolios exposed to single-stock dominance.

- Market leadership rotates quickly. What worked in one year can lag in the next, making style and stock calls difficult to sustain.

- Volatility is back as a defining feature. Instead of being a nuisance, volatility can be a resource—if portfolios are structured to capture the opportunities it creates.

Advisors face a dilemma: stick with index funds that no longer behave like broad exposure, or double down on active bets that are increasingly hard to defend with clients. Peregrine chose a third path: anchoring portfolios in a process that is disciplined, systematic, and designed to adapt as markets evolve.

For clients, that means less reliance on stories and more confidence that portfolios are built to hold up—not just in one market cycle, but across many.

Conclusion

Markets will always have stories. Some excite, some reassure, and some even prove true for a time. But stories come and go. Structure is engineered to endure.

Peregrine’s experience shows that advisors don’t have to choose between concentrated indexes or high-conviction stock pickers. By prioritizing diversification, balance, and disciplined rebalancing, they found a way to build portfolios that remain aligned with benchmarks—yet less beholden to market narratives.

The lesson is clear: in core equity, durability doesn’t come from predicting the next chapter. It comes from building portfolios that hold up no matter how the story unfolds.

Download the full Peregrine case study to see how one RIA reshaped its core allocation by choosing structure over stories.