Core equity investing often centers on one question: Which stocks will perform best? But there’s more to portfolio growth than stock selection alone.

While stock effects—the returns driven by individual company fundamentals—are important, they are only part of the equation. The other part is less talked about but just as real: volatility effects. This overlooked return source emerges from how stocks move in relation to one another and can be systematically captured through portfolio construction.

More Than Stock Picking

This foundational insight is often overlooked by traditional managers, but it lies at the core of Intech’s investment philosophy. Formalized in Stochastic Portfolio Theory (SPT), developed by Intech’s founder, Dr. E. Robert Fernholz, the framework decomposes portfolio growth into two distinct sources:

- Stock Effects – Gains or losses that come from changes in a company’s intrinsic value.

- Volatility Effects – Incremental returns generated by the differences in how individual stocks’ prices move over time.

This decomposition is not just theoretical. It provides a precise mathematical framework that helps us quantify and pursue structural sources of return that many strategies ignore. But the power of the approach lies not only in recognizing both components—it lies in integrating them within a unified, systematic process.

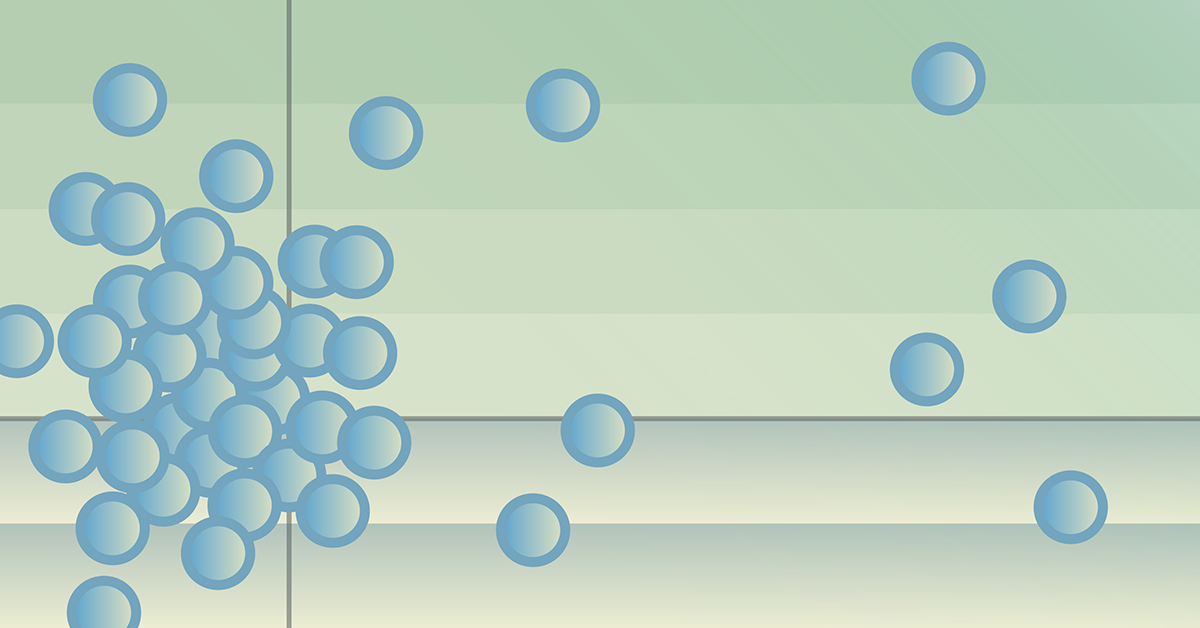

Figure 1 below illustrates this decomposition visually, showing how a portfolio’s compound return can be broken into the weighted average of the individual stocks’ compound returns (stock effects) and an interaction term that captures the structural contribution of volatility and correlation (volatility effects).

FIGURE 1: ARE TWO ENGINES BETTER THAN ONE?

Under Stochastic Portfolio Theory (SPT), developed by Intech founder Dr. E. Robert Fernholz, volatility effects are not random noise—they are a quantifiable part of portfolio growth.

The process works like this:

- Stock prices move differently based on their fundamentals, market sentiment, and other factors.

- These differences create changes in portfolio weights.

- By systematically rebalancing—selling a portion of stocks that have risen relative to others and adding to those that have fallen—the portfolio can capture a rebalancing premium.

This premium does not depend on predicting the direction of the market or timing specific factors. Instead, it relies on relative stock volatility.

Why Volatility Effects Are Overlooked

Despite being measurable, volatility effects rarely take center stage in investment conversations. There are several reasons:

- Narrative bias – Stock-picking stories are more compelling and easier to market.

- Attribution blind spots – Traditional performance reports rarely isolate volatility effects.

- Implementation challenges – Capturing these effects requires consistent rebalancing, which is not easily overlaid on a traditional fundamental process.

As a result, many portfolios either miss the opportunity entirely or capture it inconsistently.

Maintaining Alignment with the Benchmark

One of the most important considerations for fiduciary advisors, CIOs, and platform gatekeepers is tracking error. Large deviations from a benchmark can complicate model portfolio management and client communication.

Strategies that systematically capture volatility effects can be designed to keep tracking error low, maintaining compatibility with established allocation models. This is critical for integrating them as core holdings without causing unintended style drift.

Core equity can capture more of the market’s potential by paying attention to how stocks interact—not just which ones you own.

Volatility and Diversification

In a cap-weighted index dominated by a few large companies, diversification can erode over time. Volatility effects provide a mechanism to refresh that diversification without making wholesale shifts in holdings. The process is data-driven and scalable, using volatility and correlation measures to determine weight adjustments.

This doesn’t require excluding large companies. Instead, it ensures they don’t dominate portfolio dynamics to the point where diversification breaks down.

The Takeaway

Volatility effects are often misunderstood as a risk to be minimized. In reality, we believe volatility’s ever-present nature in markets offers investors a potential return source when harnessed systematically. By integrating both effects into a disciplined, systematic process, portfolios can preserve the benefits of benchmark alignment while improving their diversification profile.

If you’re ready to see how volatility effects can fit into your core equity allocation, download the full paper to learn how these concepts are applied in Intech ETFs.