Where Indexing Ends, Insight Begins

Rethink the rules. Rewire the core.

Featured Insight

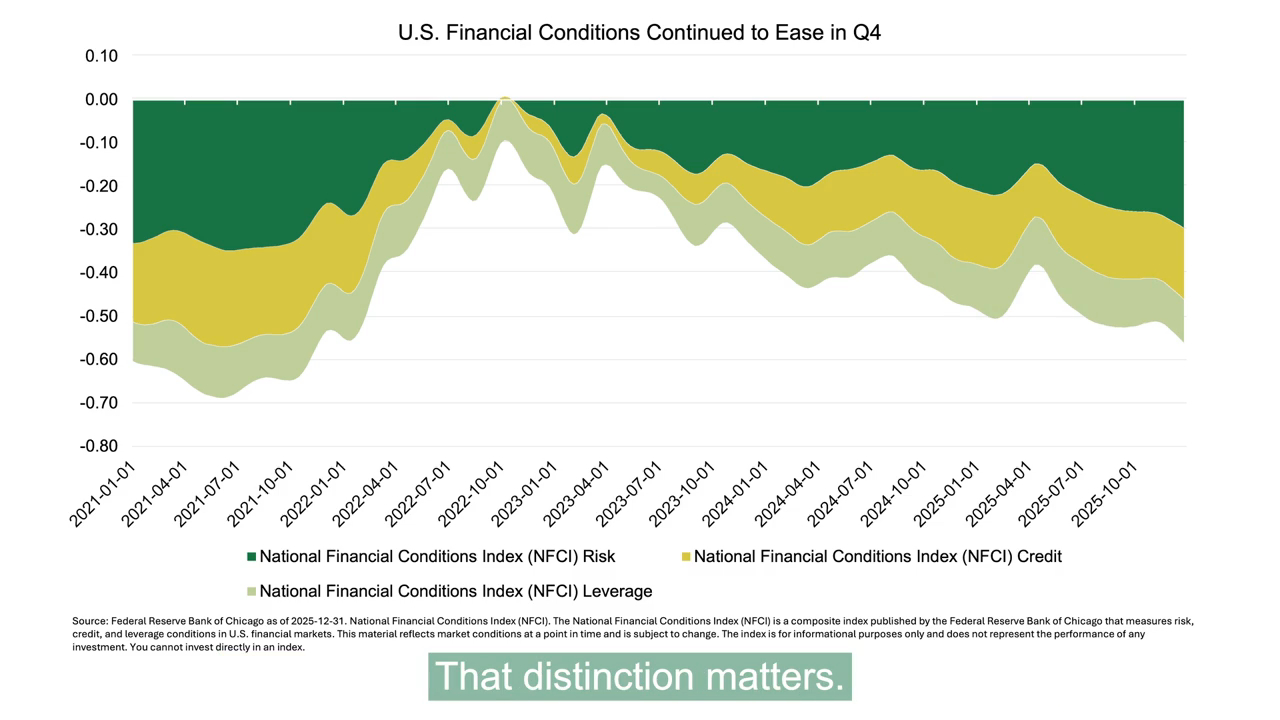

The outlook does not hinge on a single catalyst. Instead, it reflects a set of reinforcing dynamics.

Richard Yasenchak, CFA, describes why SMID-caps broaden diversification and growth potential.

Intech’s Q3 2025 Market Update reviews LGDX and SMDX ETF performance, market dispersion trends, and concentration risk.

Richard Yasenchak, CFA, describes why volatility effects can contribute to equity returns and help improve diversification without abandoning benchmark alignment.