Where Indexing Ends, Insight Begins

Rethink the rules. Rewire the core.

Featured Insight

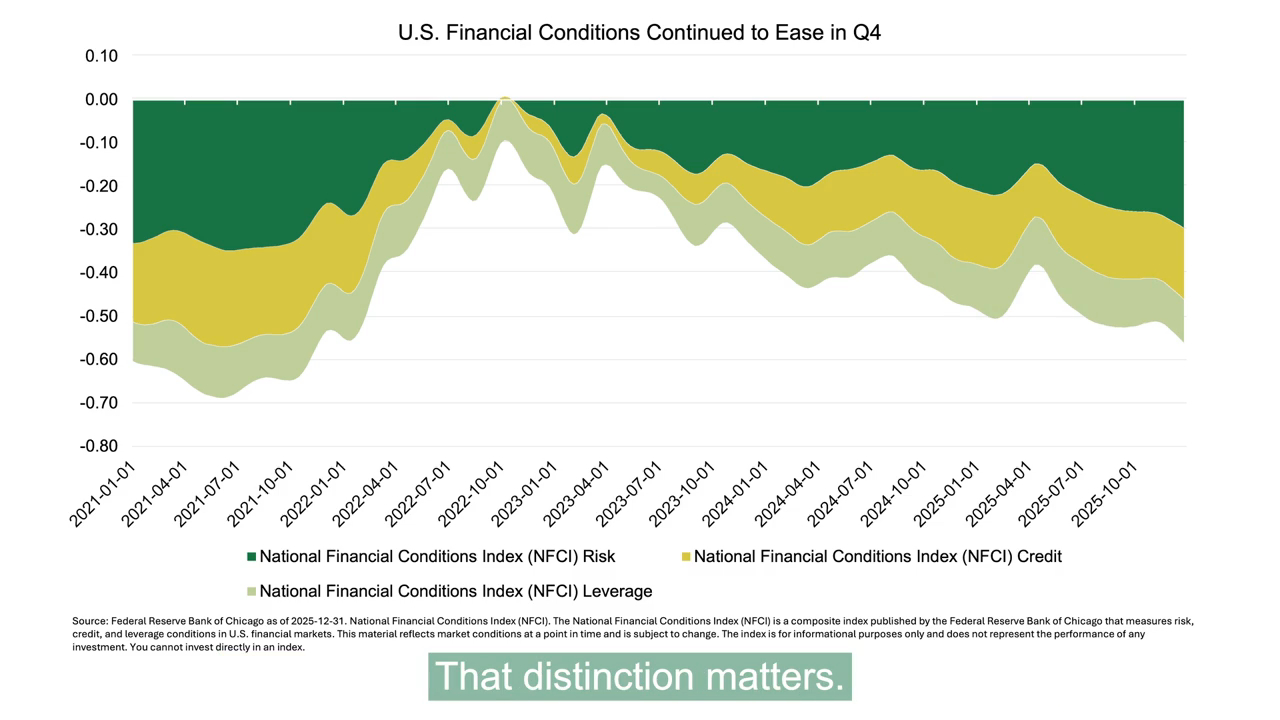

The outlook does not hinge on a single catalyst. Instead, it reflects a set of reinforcing dynamics.

Intech’s 2026 Outlook reviews broadening equity leadership, widening return differences, and shifting fundamentals heading into the new year.

Stock and factor stories fade. Learn how Peregrine built portfolios on structure, diversification, and discipline instead of market narratives.

Traditional barbell portfolios face challenges in today’s market. Learn how advisors can use structure to adapt through market regimes.